Planning for retirement is important to ensure you have enough savings to last through your golden years. Our retirement nest egg calculator can help you estimate how much you need to have saved by the time you retire.

What is a Retirement Nest Egg?

Your retirement nest egg is the amount of money you have saved and invested for retirement. This money allows you to cover living expenses and maintain your standard of living when you are no longer working a job with a steady paycheck.

How the Retirement Calculator Works

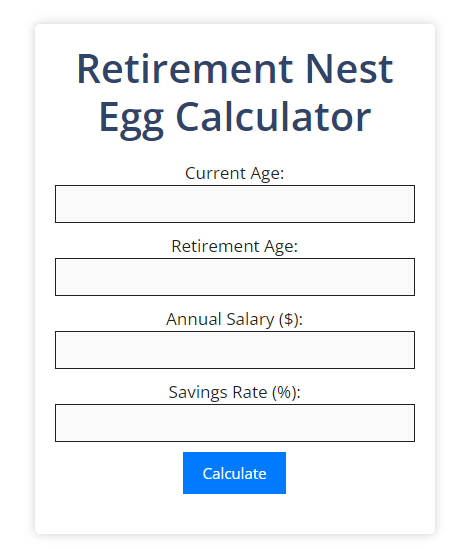

This calculator makes some assumptions about your retirement needs and uses those to estimate the target size of your retirement savings. Here’s how it works:

- Current age – Your current age is used to determine how many years you have until retirement

- Retirement age – The age you plan to fully retire. This is used to calculate how long your savings need to last.

- Current retirement savings – How much you already have saved for retirement. This is subtracted from the total needed.

- Annual retirement income needed – How much income you need your retirement nest egg to generate each year.

- Expected rate of return – The average interest rate your retirement savings are expected to earn each year.

- Life expectancy – How long your retirement savings need to last. Life expectancy is based on your gender and retirement age.

The calculator uses these inputs to determine your retirement savings goal amount. It factors in anticipated growth on your current savings, how many years retirement needs to last, and the safe withdrawal rate to prevent outliving your money.

The table below provides a quick glance at some sample nest egg targets based on different annual income needs and retirement ages:

| Annual Retirement Income Needed | Retirement Nest Egg Target by Retirement Age |

|---|---|

| $40,000 | 65: $700,000 70: $900,000 75: $1,200,000 |

| $60,000 | 65: $1,050,000 70: $1,350,000 75: $1,800,000 |

| $80,000 | 65: $1,400,000 70: $1,800,000 75: $2,400,000 |

As you can see, delaying retirement by just 5 years can significantly reduce the required savings target. Planning early is key!

Important Factors That Affect Your Target

Many variables impact just how large your retirement nest egg needs to be. Here are some of the key factors to keep in mind:

- The younger you are when you start saving, the more time your money has to grow.

- The older you plan to be when you retire, the fewer years your savings need to last.

- The more you already have saved, the less additional principal you’ll need.

- The higher your expected spending in retirement, the more you need saved.

- If you anticipate a lower retirement income compared to your current salary, you may need less.

- The higher the rate of return you can reasonably expect, the lower the required nest egg amount.

- The longer your life expectancy and retirement timeframe, the more savings you need.

Use the retirement calculator now to get a starting point estimate, then consider adjusting the inputs to reflect your unique situation. Planning early, saving consistently, and investing wisely are key to building the nest egg you need to enjoy your golden years.